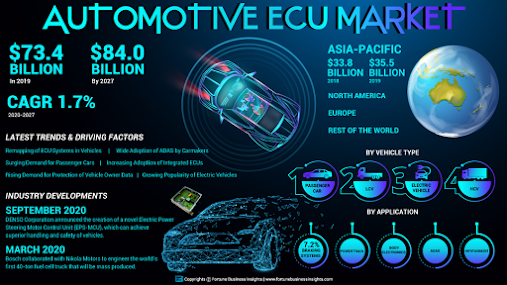

The global automotive

electronic control unit market size is projected to reach USD 84.0 billion

by 2027, exhibiting a CAGR of 1.7% during the forecast period. Growing adoption

of integrated ECUs by car-buyers will lead to sustained progress of this

market, highlights Fortune Business Insights™ in its report, titled “Automotive

Electronic Control Unit (ECU) Market Size, Share & COVID-19 Impact Analysis,

By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial

Vehicle and Electric Vehicle), By Application (Powertrain, Braking System, Body

Electronics, ADAS, Infotainment) and Regional Forecast, 2020-2027”.

Electronic control units are designed to automate the core functions of

vehicles, which not only elevate their efficiency but also make them safer and

smarter. Integrated or single-system ECUs have emerged as an alternative to the

multiple ECU systems, offering considerable advantages over the latter. For

example, a multiple ECU system is expensive as it consists of different parts,

while an integrated ECU is naturally less costly as it’s a unified system,

which is also easier to design. Similarly, carmakers need to invest fewer hours

and monies in testing single ECU systems as there is only one unit that needs

to be tested; for multiple ECU systems, more time and money are required for

testing, thereby inflating development costs. Thus, the cost-effectiveness and

operational efficiency of integrated ECUs are fueling their adoption and boosting

the growth of this market.

List of Key Companies Profiled in the Automotive Electronic Control

Unit Market Report:

- NXP

Semiconductors N.V. (Eindhoven, Netherlands)

- Valeo Inc.

(Paris, France)

- Robert Bosch

GmbH (Stuttgart, Germany)

- Hyundai

Mobis (Seoul, Korea)

- Continental

AG (Hanover, Germany)

- Delphi

Technologies (London, U.K)

- Altera

(Intel Corporation) (California, United States)

- Autoliv

(Stockholm, Sweden)

- DENSO

Corporation (Kariya, Aichi, Japan)

- ZF

FRIEDRICHSHAFEN AG (Friedrichshafen,

Germany)

As per the

ECU market report, the value of the market stood at USD 73.4 billion in 2019.

The main features of the report include:

· Comprehensive

study of the factors driving and restraining market growth;

· Detailed

analysis of the market segments and opportunities;

· Tangible

insights into the regional dynamics shaping the market; and

· Microscopic

examination of the leading players and their key strategies.

Market Restraint

Steep Decline in Sales & Closure of Plants amid COVID-19 to

Stall Growth

The economic fallout in the

automotive industry precipitated by the COVID-19 pandemic is likely to hit the

automotive electronic control unit market growth. For example, according to the

Oxford Business Group (OBG), in March 2020 the demand for light vehicles in the

European Union shrunk by 44%, while in the ASEAN it contracted by 40%. In the

US, passenger vehicle sales reduced by 46% in April 2020, the OBG reported in

June. Declining sales, lockdowns, and social distancing also forced several

automakers to close their manufacturing plants, a trend that was highly

noticeable in Europe. Fiat Chrysler, for instance, closed several plants across

Italy, Poland, and Serbia in March 2020. Volkswagen and France-based PSA Group

had to take similar measures. Such drastic turn of events is inhibiting the

adoption of ECUs and stalling the growth of this market in the process.

Read Detailed Summary of This Research Report:

Regional Insights

Increasing Purchasing Power in Asia Pacific to Favor Regional

Market Growth

Asia Pacific dominated the

automotive electronic control unit market share in 2019, boasting a market size

of USD 35.5 billion. The region is expected to retain its apex position during

the forecast owing to the rising willingness among consumers in the region to

purchase high-end cars, which is a direct result of the increasing disposable

income.

In North America, the top growth

driver for the market will be the increasing preference for advanced automotive

ECUs for enhanced safety of occupants. On the other hand, the market in Europe

is anticipated to showcase an impressive growth trajectory on account of the

strong presence of some of the world’s biggest automakers, such as Volkswagen

and BMW, in the region.

Competitive Landscape

Investments in Cutting-Edge Technologies to Give Key Players

Strategic Edge

Key players in the automotive ECU

market are steadily expanding their investments in next-gen, cutting-edge

vehicular electronics to gain a competitive edge over other participants.

Besides this, companies are also partnering with other competitors to broaden

their innovation horizons.

Industry Developments:

· September 2020: DENSO

Corporation announced the creation of a novel Electric Power Steering Motor

Control Unit (EPS-MCU), which can achieve superior handling and safety of

vehicles. It made its debut in the Toyota Harrier that was launched in June

2020.

· March 2020: Bosch collaborated with Nikola Motors to engineer the world’s first 40-ton fuel cell truck that will be mass produced. A key component of the Nikola Two trucks is the Vehicle Control Unit developed by Bosch to manage the complex electric & electronic power that these trucks need.

Read Press Release:

No comments:

Post a Comment